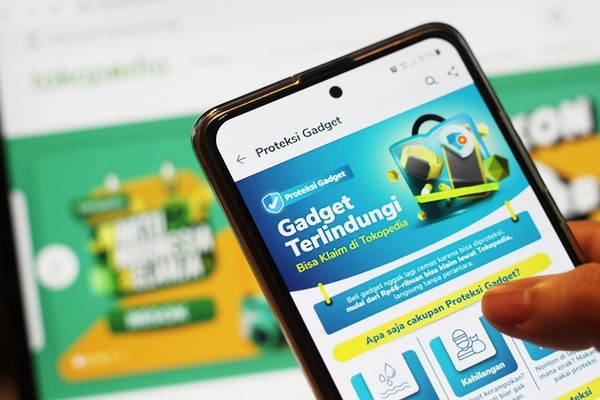

Mobile Phone Insurance: Essential Protection for Your Gadget

Mobile phones have become an integral part of daily life, serving not just as communication tools but also as hubs for work, learning, and entertainment.

With the significant investment tied to these devices, mobile phone insurance provides a financial safety net against potential losses from damage, theft, or loss. In this article, we’ll explore what mobile phone insurance is, its benefits, coverage options, and tips for selecting the right policy.

What is Mobile Phone Insurance?

Mobile phone insurance is a type of coverage designed specifically to protect your device against various risks that could lead to financial loss. These risks include physical damage, theft, loss, and water damage. With mobile phone insurance, you can significantly reduce repair or replacement costs.

Benefits of Mobile Phone Insurance

1. Reduced Repair Costs

Mobile phone insurance covers part or all of the repair expenses for issues like cracked screens or damaged components.

2. Protection Against Theft or Loss

If your phone is stolen or lost, the insurance can replace it with the same or equivalent model.

3. Coverage for Water Damage

Many policies cover water-related damage, such as spills or devices dropped in water.

4. Quick Replacement

Insurance allows you to get a replacement device much faster than purchasing a new one out-of-pocket.

5. Peace of Mind

Knowing you’re financially protected against unexpected risks provides a sense of security.

Types of Coverage Offered

1. Physical Damage

Covers repair costs for physical issues like broken screens, scratches, or internal hardware failures.

2. Theft or Loss

Replaces your phone if it is lost or stolen, provided you report the incident to authorities.

3. Water Damage

Protects your device from liquid damage caused by spills, rain, or immersion in water.

4. Software Protection

Some policies include software-related coverage, such as data recovery or virus removal.

Tips for Choosing Mobile Phone Insurance

1. Understand Your Needs

Identify the risks you are most concerned about, such as physical damage, theft, or loss, and choose a policy that matches these needs.

2. Compare Providers

Research multiple insurance companies and their products to find the best coverage at the right price.

3. Check Terms and Conditions

Read the policy details carefully, including exclusions, claim procedures, and time limits for filing claims.

4. Verify the Insurer’s Reputation

Select an insurance provider with a good reputation and transparent claims processes.

5. Stay Within Budget

Choose a premium that fits your budget without compromising on essential coverage.

How to File a Mobile Phone Insurance Claim

1. Report Immediately

If your phone is damaged, lost, or stolen, notify the insurance provider as soon as possible.

2. Prepare Necessary Documents

Gather required documents such as proof of purchase, a police report (for theft or loss), and photos of the damage.

3. Follow the Claim Procedure

Each provider has its own claim process. Ensure you follow their specific steps to expedite your claim.

4. Wait for Verification

Once all documents are submitted, the insurance company will verify your claim before approving repair or replacement.

Conclusion

Mobile phone insurance is a smart investment to protect your device against potential financial losses. By understanding its benefits, coverage options, and how to choose the right policy, you can ensure your phone remains secure.

If your phone is essential for work or you own a high-value device, mobile phone insurance can be a worthwhile decision. Be sure to select a reputable provider and a plan tailored to your specific needs for maximum protection.